Current Temperature

16.3°C

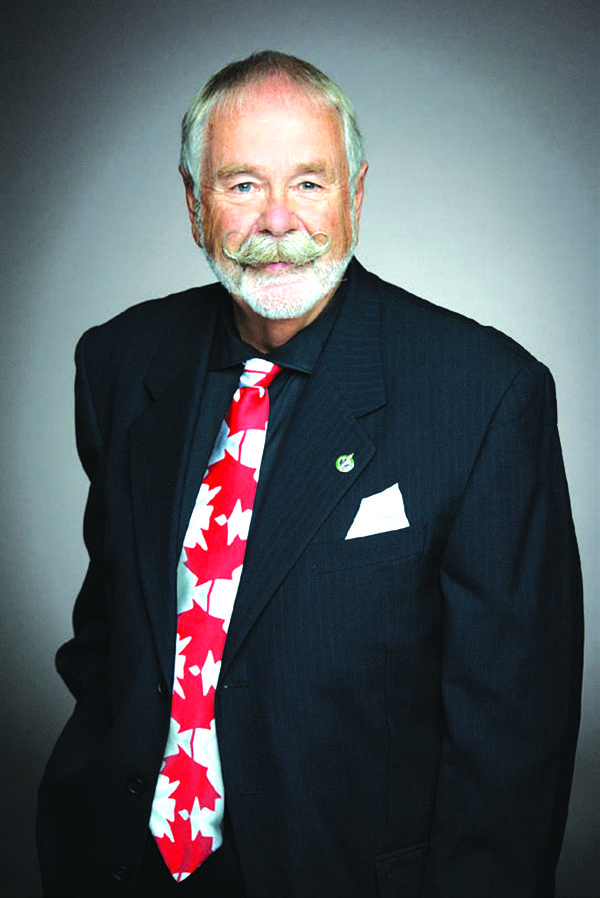

MP Shields speaks out against carbon pricing

Posted on October 4, 2023 by Taber Times

By Ian Croft

Taber Times

Local Journalism Initiative Reporter

With the Canadian House of Commons reconvened, MP for Bow River Martin Shields did not hesitate to rise in the House on Sept. 26 to discuss some issues that was brought to his attention during the parliamentary break.

“It is good to see you back and good to see my colleague on the opposite side. We have had many conversations over the years, and I appreciate the opportunity to have that discussion again tonight,” said Shields. “One of the things that happened in this particular summer was a tour. There were ag journalists from all over the world at a conference in Alberta. One of the options they had was to tour around to different places. One of the tours was in my riding, looking at irrigation and ag producers. It was a privilege to be invited along with this busload of journalists from around the world, and I was sitting beside one from Montreal, one from Iowa in the U.S. corn belt, and another one from Brazil. We talked about agriculture. Of course, because I am from the government, the journalists asked me about the policies of how it works.”

Shields of course took this opportunity to talk about a rather familiar issue, that of carbon tax.

“I could not resist asking about carbon tax. The journalist from Montreal suggested that they did not have a carbon tax because they have cap and trade. I asked, ‘What about the second carbon tax, the clean fuel standard?’ He said, ‘Oh, we do not have that in Quebec.’ I said that he might want to check on that. The journalist from the U.S. said, ‘carbon tax?’ She was not familiar with it in their country. I said, ‘When we stop at producers’ places, why not ask them about the carbon tax?’ We are not talking about the diesel. We are not talking about rebates, because these ag producers do not get a rebate. These people are not the rebate people. We are talking about the power for electricity on pumps for irrigation. Seventy per cent of the irrigation in the country is in my riding. That is four per cent of the arable land in Alberta producing over 20 per cent of the ag GDP.”

Following this, Shields shared how the journalists were shocked about the current state of the carbon tax in Alberta.

“When we stopped, the U.S. journalist asked a farmer whether they pay carbon tax,” said Shields. “The farmer said, ‘I have bills I can show you. I have paid $100,000 in carbon tax alone.’ Afterwards, the journalists were surprised. The one from Iowa said they did not know how we compete in the world market. They are happy in the U.S. because we cannot compete with them because they do not have that carbon tax. The one from Montreal said that they do not have a carbon tax either. I said, ‘Check on it. You have the clean fuel standard, and that is in your ag sector.’ The one from Brazil said, ‘I do not know how you are going to compete on the international market.’ That is the challenge with our irrigation: the carbon tax on the electricity. I am not talking about diesel. These guys do not get rebates. Seventy per cent of irrigation is in my riding, and the farmers are paying huge carbon tax on the electricity. This is a challenge to stay competitive. This is a challenge to stay in the ag business as producers, and it is going to triple. The ag producers do not understand how they can stay in the business.”

Shields then closed his initial discussion by pointing out how Alberta’s farmers are world leading, but are being suffocated by the carbon tax.

“We are talking about innovative agricultural producers. We are talking about carbon sequestration in their crops. We are talking about the way they are developing their crops with zero tillage. A lot of the activities they are doing are world-leading, but the carbon tax is killing our food security because these ag producers cannot sustain this level of tax on the electricity it takes for their irrigation pumps to work. It is problematic for food security in this country.”

Following his comments Adam van Koeverden, the Parliamentary Secretary to the Minister of Environment and Climate Change and the Minister of Sport and Physical Activity, and MP for Milton, rose to respond to Shields.

“I know that Conservatives do not like to deal in facts, but I am going to put a few facts on the table and the first one is around affordability. In 2006, when the Conservatives came into office, Canada ranked 17th in the OECD when it came to child poverty, and by the time they left in 2015, Canada ranked 24th,” said Koeverden. “It is a little hard to take them seriously when they talk about poverty. Members do know one thing: After coming into office in 2015, Canada now ranks second in the OECD when it comes to child poverty. There is more work to be done. Facts matter and the member deals in falsehoods and things he makes up because there are no facts on the table when talking to the member regarding climate change or poverty in this country. Another point is when the member talks about farm fuels. Farm fuels in Alberta and across the country are exempt from the price on pollution, and the reason some electricity in Alberta might be subject to carbon pricing is because 80 per cent of the grid in Alberta is still fuelled by coke, coal and natural gas. That is a problem for Canada because climate change is a problem for Canada.”

Koeverden did not hesitate to continue driving home the issue of how critical climate change is for Canadians.

“Throughout this summer, we had unabated, unprecedented wildfires that took the homes of thousands of Canadians and forced the evacuation of tens of thousands of Canadians. I will take no lessons from the Conservatives when they talk about climate change, primarily because my colleague, and all Conservative members, ran on a commitment to put in a carbon pricing scheme. Canadians looked at that plan. It was far worse than any other party’s plan to fight climate change and that is why they did not earn votes from any environmentalists in the last election. I do remind the member that he, along with all of his colleagues, including the member for Carleton, ran on a commitment to price carbon. Not only do the Conservatives have no credibility when it comes to fighting climate change, but they also have no credibility when it comes to following through on their commitments. The only thing they have been arguing over the last two years is their ‘axe the tax’ slogan for T-shirts and bumper stickers.”

Following this Koeverden also discussed how the carbon tax is not the big contributor for the increase of prices at the grocery.

“On food pricing, I will say food is too expensive in Canada,” said Koeverden. “We need to find real solutions to drive down the price of food and stabilize grocery bills for families. Trevor Tombe, an economist from the same province as my colleague came out with some facts, some figures and some actual numbers to indicate the impact that carbon pricing in Canada has on grocery bills in our country. What he came up with was a very clear representation of the exact price for an average family. Food has gone up by dozens of dollars a month, but he attributes just $2 a month on the price of groceries to the price on carbon in Ontario and $5 a month on the price of groceries for an average family in Alberta. When the member opposite says that axing the tax, as the Conservatives have been repeating ad nauseam for the last two years, it is going to be a way to fight for affordability for families, that is not based on facts. That is based on rhetoric. That is based on bumper stickers. That is based on this gut, common-sense feeling the Conservatives rely on for policy, but economists disagree. Smart economists with calculators sort these things out.”

To end his comments Koeverden stated that the conservatives are not assisting the conversation when it comes to fighting climate change or making things more affordable.

“Again, we will take no lessons from the Conservatives when it comes to affordability or fighting climate change. In budget 2023, we announced historic clean technology investments and I will get to that after the next comment.”

Shields immediately fired back by discussing the issues of the carbon tax when it comes to electricity generation.

“I can get the farmers’ bills on the actual cost of the carbon tax,” said Shields. “I am talking about electricity. I am talking about the electricity generated that it costs for food. I am talking about the actual impact of the carbon tax on our ag producers. It is a fact. About seven per cent of the generated Alberta grid is produced by solar and wind. We have more solar and wind than any other province in Canada. However, when it is -30°C in January, there is no solar power. In the summer when the wind was not blowing, there was no power for wind turbines because they were not moving. We need food security. That is economic security and that is important. I am standing up for our ag producers…”

Shields was eventually cut off by the Assistant Deputy Speaker allowing Koeverden to respond before the house was adjourned.

“This trope that renewable energy does not work in cold climates or that renewable energy requires sunny days and windy days exclusively is tired and it is not based on facts,” said Koeverden. “Alberta is the sunniest province in Canada. Its capacity for generating renewable electricity knows no bounds. The investments in renewable electricity in that province are also extraordinary, but this past summer, Premier Danielle Smith said it was putting a moratorium on any renewable energy projects for the rest of the year, putting in jeopardy its commitment to end its reliance on coal and coke. The member opposite just cited the number seven per cent. That is how much of the electricity on the grid in Alberta is generated by wind and solar; that is not enough. By the way, wind and solar are not the only renewable energy sources. We can also generate electricity with hydroelectric, nuclear and many other ways. This conversation for my colleague is one that he ought to have with his provincial colleagues in Alberta who are refusing to green their grids.”

Leave a Reply

You must be logged in to post a comment.